Bitcoin is weak at spot rates, contracting from July 2024 peaks to below $66,000. As bears press on, targeting the round number at $60,000, bulls are optimistic, expecting a rebound in the coming sessions.

Technically, the zone between $66,000 and $70,000 is a crucial zone that buyers must decisively break for the uptrend to develop. Any lift-off above $72,000 would be ideal, as it is the last resistance before an all-time high of around $74,000.

Bitcoin Struggling: Will Bulls Absorb Rising Inflows To Exchanges?

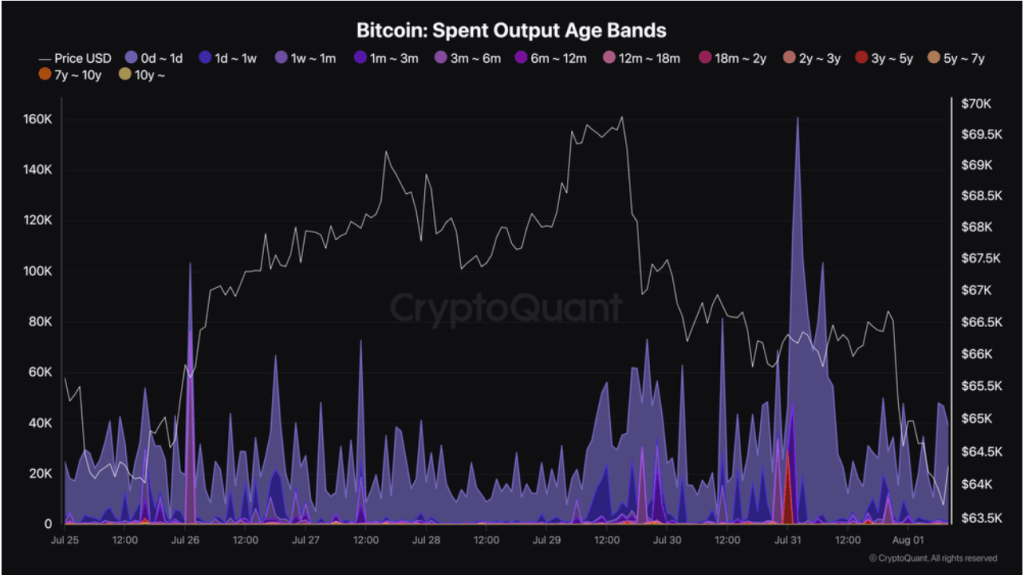

Though Bitcoin might find strength, one analyst thinks the coin will continue posting lower lows, confirming losses for the better part of this week. In a post citing CryptoQuant data, the analyst picked out how age bands have evolved over the past years and months.

Analysts use age bands to categorize coins based on the last time they were moved on-chain. Some were moved within the last week, others within the past quarter, and others within years. The analyst noted that an analysis of these bands points to increasing selling pressure.

Notably, the analyst noted that large volumes of long-term holders (LTHs) continue to be transferred to leading exchanges like Coinbase and Binance. Usually, when coins are moved to exchanges, it means the transferring entity is keen on selling, a bearish signal.

If more whales or addresses holding big batches of BTC move coins to exchanges, it could be a leading signal that prices will crash.

The analyst observed that the spike in coins transferred by LTHs to leading exchanges coincided with price declines, as seen from late July 2024. Even though the market has matured, the analyst warns that the influx of new coins will likely delay price recovery.

Will BTC Shake Off Weakness? Inflows To Spot ETFs Crucial

Looking at the daily chart, it remains to be seen whether bulls will step in today and soak in the deluge of selling pressure seen this week. The immediate support is at around the $60,000 and $63,000 zone. If there is a recovery above this area, Bitcoin might edge higher, shaking off this week’s weakness.

Still, historically, how fast prices recover or dump depends on inflows, mostly from newcomers. This, however, has been disrupted with the introduction of spot Bitcoin ETFs in the United States.

One analyst, citing recent developments, points out that the recent swing high, taking the coin to over $72,000, wasn’t backed by a spike in inflows from newcomers. Instead, as the analyst assesses, BTC prices are highly influenced by inflows into spot ETFs, that is, mainly institutions.

As prices drop, sentiment might be impacted, leading to outflows. If more capital is pulled from spot ETFs, the BTC sell-off would be more severe. On August 1, all ten spot Bitcoin ETFs in the United States saw outflows of 1,500 BTC, or over $94 million, Lookonchain data shows.

by Dalmas Ngetich via Bitcoinist.com

Comments

Post a Comment