Amid the buzz and anticipation, Standard Chartered, a British cross-border bank, has projected that Ethereum spot ETFs will likely be approved by the US Securities and Exchange Commission (SEC) this week.

According to the bank, the approval of these spot ETFs could catalyze significant market inflows, with estimates ranging from $15 billion to $45 billion in the first year alone.

Additionally, this anticipated influx of capital is expected to substantially boost Ethereum’s market dynamics, potentially driving its price toward the $8,000 mark by the end of 2024.

Implications Of Ethereum ETFs Approval:

Notably, the bullish outlook from Standard Chartered is supported by the imminent deadlines for the first round of spot Ethereum ETFs, with VanEck’s deadline on May 23 and Ark Invest/21Shares’ on May 24.

Geoff Kendrick, Head of FX Research and Digital Assets Research at Standard Chartered Bank, expressed high confidence in approving these ETFs, estimating an “80% to 90%” probability. Kendrick particularly noted:

After approval, we estimate that spot ETFs will drive inflows of 2.39-9.15 million ether in the first 12 months after approval. In U.S. dollar terms, that equates to roughly $15 billion to $45 billion. As a percentage of market cap, it is similar to our estimates of inflows to bitcoin ETFs, which are proving accurate.

Kendrick elaborated that if the spot ETH ETFs receive approval as anticipated, Ethereum could maintain its current price ratio with Bitcoin, which is projected to reach $150,000 by the end of 2024. This projection places Ethereum at an $8,000 valuation by the end of the year.

Moreover, with Standard Chartered’s forecast of Bitcoin reaching $200,000 by the end of 2025, Ethereum could also see its price rise to $14,000 over the same period, reaffirming the bank’s earlier price target in March.

Bullish Market Sentiment Amid Rising ETF Approval Odds

Following the increased likelihood of Ethereum ETF approvals, the price of Ethereum has surged, crossing the $3,600 level for the first time since April 19.

This represents a more than 20% increase in the past 24 hours, pushing Ethereum’s market capitalization above $450 billion.

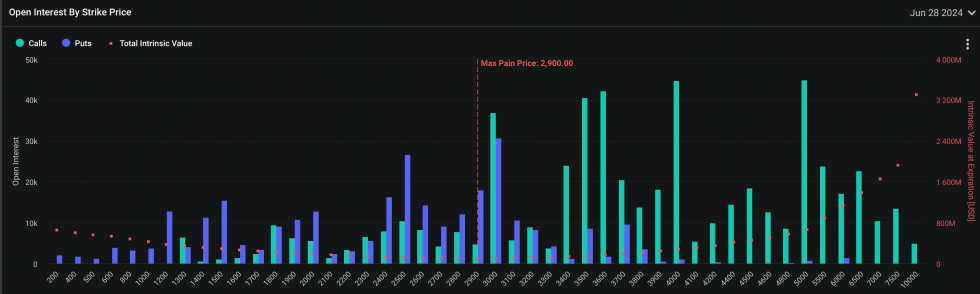

The market’s response to these developments has been overwhelmingly positive, with derivative markets like Deribit showing concentrated bets on Ethereum calls surpassing the $4,000 price mark. The most favored strike price among these options traders is an ambitious $5,000, indicating strong bullish sentiment.

Notably, Bloomberg analysts heightened optimism about the approval of spot ETH ETFs by unexpectedly increasing the approval odds to 75%, a significant jump from the earlier 25% estimation.

This reassessment followed reports that the SEC is rapidly changing its stance, with exchanges being urged to update their 19b-4 filings swiftly.

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they’d be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

According to Eric Balchunas, approval could come this Wednesday, signaling a major shift in the regulatory landscape and potentially setting the stage for further gains in ETH’s price.

Featured image created with DALL·E, Chart from TradingView

by Samuel Edyme via Bitcoinist.com

Comments

Post a Comment