Even after reaching a new all-time high on March 11, the founder of LookintoBitcoin, Philip Swift, in a post on X, believes the Bitcoin bull market is just getting started and has “a long way to go.” Supporting this bullish preview, Swift points to a popular on-chain metric, the MVRV Z-Score, which currently sits at 2.87.

Bitcoin Bulls In Charge, MVRV Z-Score Low

Bitcoin bulls have been relentless when writing, driving prices to fresh highs. After easing past $70,000 last week, prices roared higher on March 11, pushing the coin to an all-time high of $72,800. Bulls remain buoyant, expecting more gains and even new all-time highs in the coming sessions.

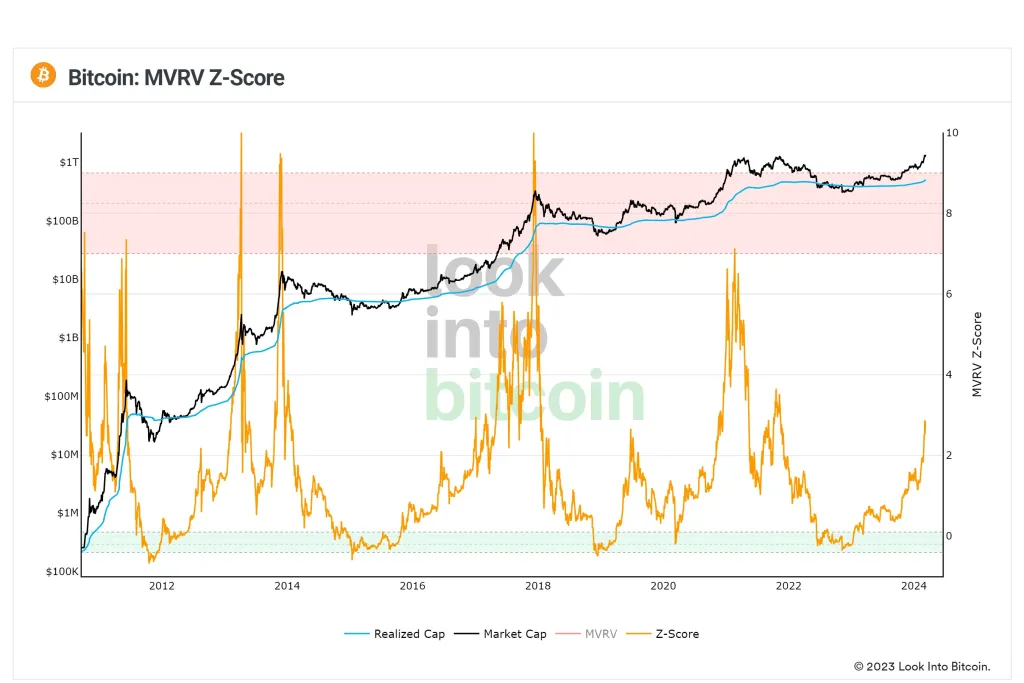

While this develops, the MVRV Z-Score remains low but rising as of March 12. On-chain analysts often leverage this metric to assess the stage of the bull cycle. Analysts can use this tool to determine periods when Bitcoin is undervalued relative to its fair value.

Historically, and as explained by LookintoBitcoin, the MVRV Z-Score has proven helpful in identifying when spot rates have surged well beyond the realized value. In this case, the realized value is the average price holders paid for all the circulating coins.

From LookintoBitcoin data, the MVRV Z-Score is up to 2.87, rising from 2.82 when Swift posted on X. When Bitcoin prices soared to all-time highs in the last bull cycle in 2021, the score stood at over 5.

Accordingly, at spot readings, the low reading suggests that bulls have more room to drive prices even higher in the coming sessions. This also means that the current all-time high of $72,800 will likely be broken as prices soar.

As Bitcoin trends at around all-time highs and confidence grow, the low MVRV Z-Score only adds to the growing chorus of bullish sentiment surrounding the world’s most valuable coin. The current spike is mostly pinned on institutions doubling down on the coin, taking more coins from circulation.

Wall Street Players Accumulating BTC

MicroStrategy, the business intelligence firm trading on Nasdaq, has accumulated Bitcoin. Presently, the firm controls 205,000 BTC worth over $9 billion, bought at an average price of slightly less than $34,000. From February 26 to March 10, MicroStrategy bought another 12,000 BTC.

Moreover, spot Bitcoin exchange-traded fund (ETF) issuers are amassing more coins on behalf of their clients. As of March 11, Lookonchain data shows that BlackRock bought 4,853 BTC, pushing their total haul close to 196,000 BTC.

by Dalmas Ngetich via Bitcoinist.com

Comments

Post a Comment