On-chain data shows the Bitcoin exchange supply has resumed its downtrend recently, after earlier deviating towards a rise.

Bitcoin Percent Supply On Exchanges Has Dropped To 11.8%

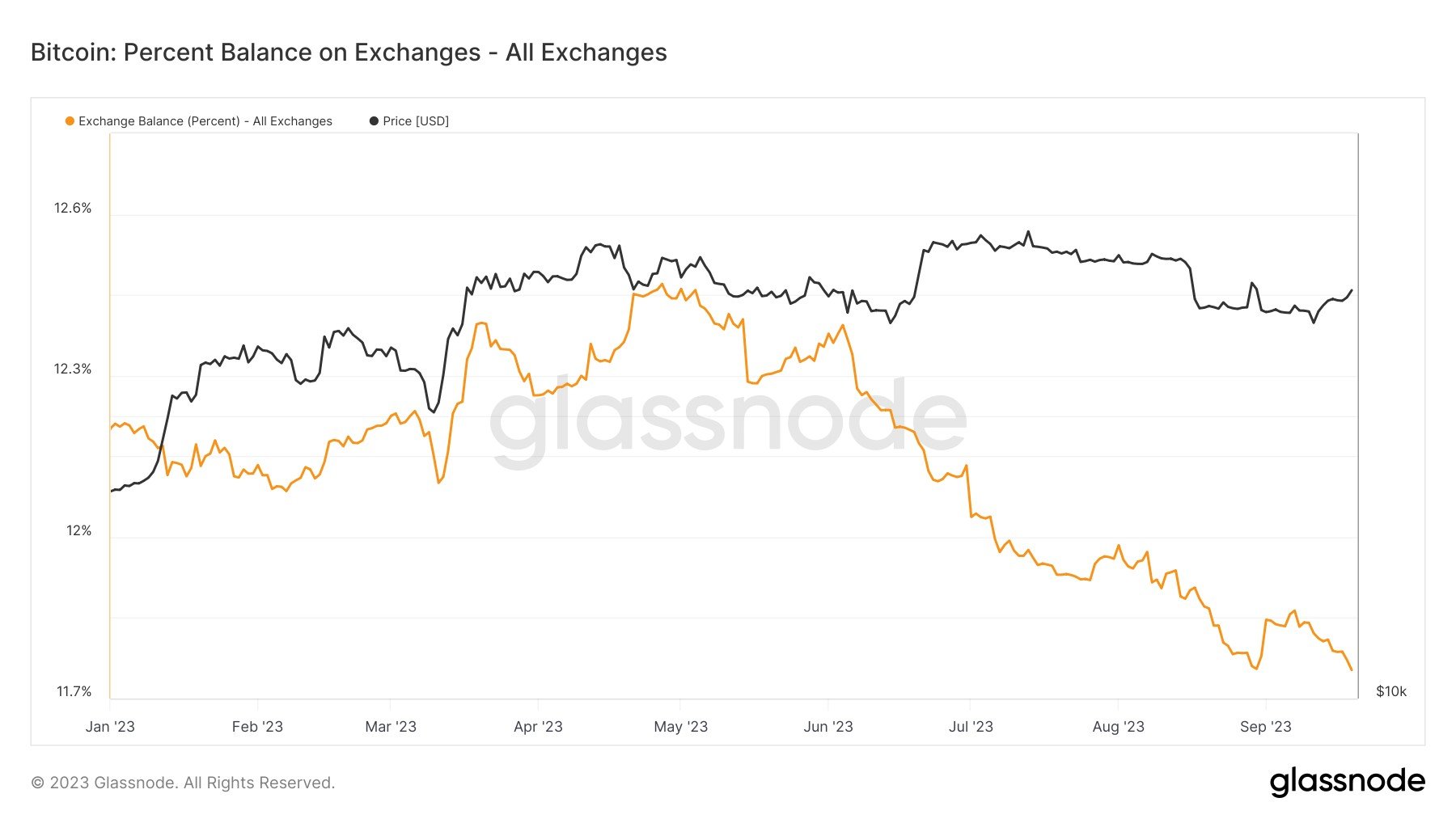

As pointed out by an analyst in a post on X, the BTC exchange supply is back to its year-to-date (YTD) lows. The relevant metric here is the “percent balance on exchanges,” which keeps track of the total percentage of the Bitcoin supply that’s currently sitting in the wallets of all centralized exchanges.

When the value of this indicator goes up, it means that the investors are depositing a net amount of the cryptocurrency into these platforms. As one of the main reasons why investors make such transfers is for selling purposes, this kind of trend can carry potential bearish effects for the coin.

On the other hand, the metric’s value going down implies the holders are moving their coins away from these central entities into their self-custodial addresses. Generally, investors who show this behavior plan to hold for extended periods, so such a trend could be bullish for the price in the long term.

Now, here is a chart that shows the trend in the Bitcoin percent balance on exchanges since the start of the year 2023:

As shown in the above graph, the Bitcoin percent supply on exchanges had been going up during the starting months of the year, as BTC had observed its rally. These deposits were likely being made by sellers looking to book their profits.

Since June, however, the supply on exchanges has followed a sharp downtrend, implying that investors have been constantly taking their coins out from these platforms.

Interestingly, this is despite the fact that BTC had initially observed a further uptrend in this period, suggesting that the accumulators had outweighed any profit sellers who looked to take advantage of the opportunity.

Earlier in the month of September, the indicator had reversed its trend, as exchanges saw net deposits of about 25,000 BTC. This rise couldn’t last for too long, however, as the metric has come back down in the days since then.

Today, the Bitcoin percent supply on exchanges has hit the 11.8% mark, which is the lowest value observed since the start of the year. Naturally, this means that the prior rise has been completely retraced.

It’s hard to say what consequences these continued withdrawals might have for the cryptocurrency in the short term, as the net outflows in the past few months haven’t been able to save the asset from its drawdowns.

From the long-term perspective, though, supply continuously moving toward self-custody is certainly a constructive sign, as it leads to the coin becoming more decentralized.

As the chaos of the bankruptcies of major platforms like 3AC and FTX taught us last year, the fewer coins that sit on these central entities, the better it is for the stability of the market.

BTC Price

The Bitcoin rally has hit the brakes recently as the cryptocurrency has been unable to find any sustained break toward higher levels. At present, the coin is trading at $27,100.

by Hououin Kyouma via Bitcoinist.com

Comments

Post a Comment