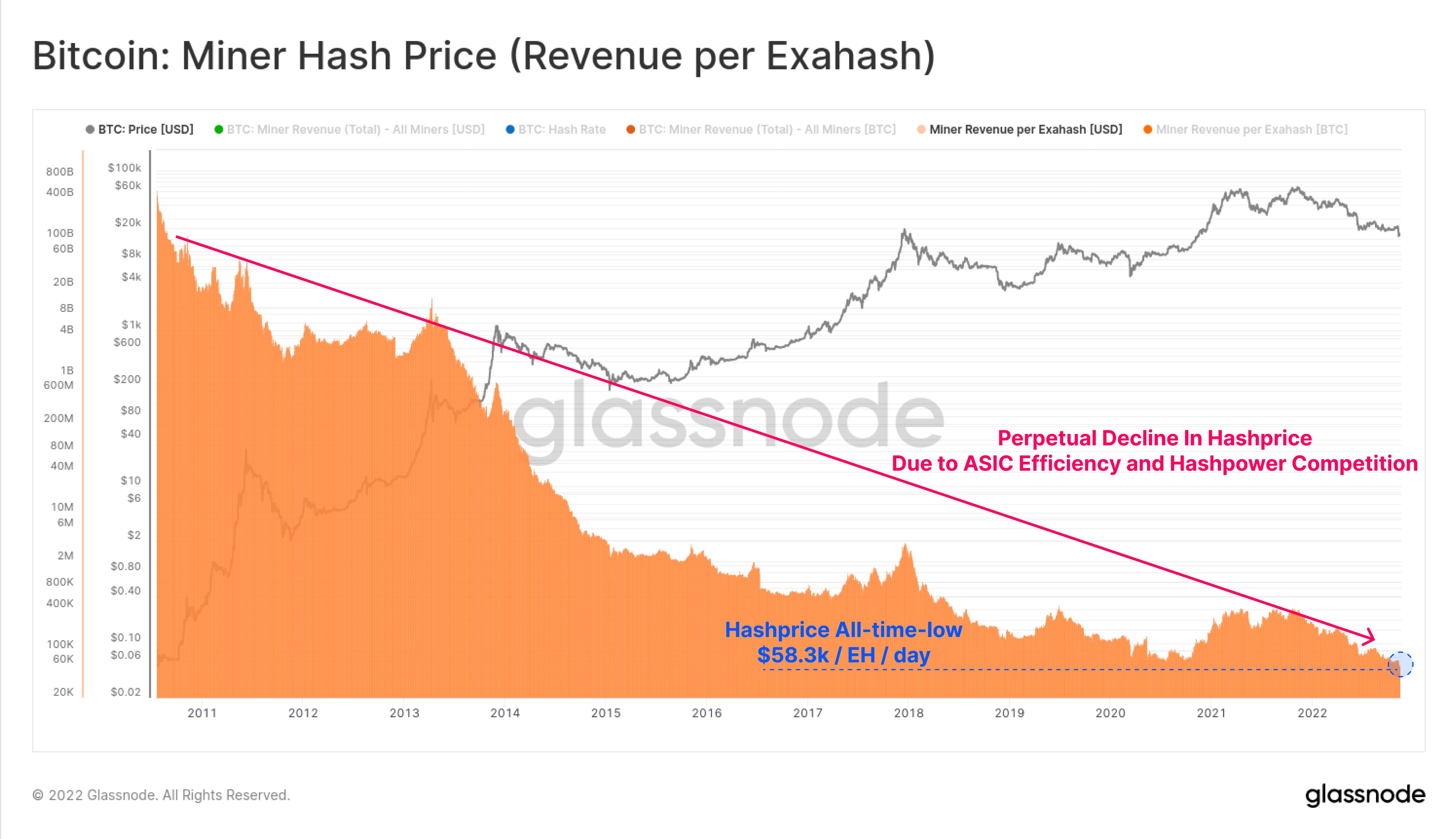

Data shows that the Bitcoin miner hash price has now declined to $58.3k per Exahash per day, a new all-time low for the metric.

Bitcoin Miner Hash Price Has Continued To Trend Down Recently

As per data from the on-chain market intelligence firm Glassnode, miners have remained under extreme pressure in this drawdown.

The “miner hash price” is an indicator whose value is calculated by taking the ratio between the daily miner revenues and the mining hashrate.

Here, the “mining hashrate” refers to the total amount of computing power currently connected to the BTC network, and its value is measured in Exahash per second (EH/s).

What the hash price tells us is the income that miners are generating per each unit of this computing power every day.

Now, here is a chart that shows the trend in this Bitcoin indicator over the entire history of the crypto:

As you can see in the above graph, the Bitcoin miner hash price has been on an overall trend of perpetual decline since the creation of the crypto.

The reason behind this lies in the concept of “mining difficulty.” This is a feature of the BTC blockchain that ensures the chain validators only mine at a constant, network-intended rate.

Whenever the hashrate goes up, miners are able to produce blocks faster thanks to the extra computing power. But as the network doesn’t want that, it increases the difficulty, slowing the miners down to the required speed.

This means that despite the higher hashrate, miners are still only able to mine the same amount of block rewards per day, and thus the hash price declines.

There are also some other factors at play here, like the halvings that take place every 4 years and cut the block rewards down in half.

And there is obviously the Bitcoin price, which changes how much revenue miners make in USD. During bull runs, the miner hash price (temporarily) breaks the downtrend and observes some rise due to the large jumps that BTC observes in such periods.

The recent months haven’t been kind to the miners as the hashrate has been shooting up while the price has been constantly declining, leading to the hash price sharply falling off.

Following the latest plunge, the Bitcoin miner hash price has set a new all-time low of $58.3k per Exahash per day.

BTC Price

At the time of writing, Bitcoin’s price floats around $16.6k, up 1% in the last week.

by Hououin Kyouma via Bitcoinist.com

Comments

Post a Comment