On-chain data shows Bitcoin miners withdrew a large amount of coins from their wallets yesterday, suggesting they may be planning to sell them.

Bitcoin Miners Transferred 14k BTC Out Of Reserve Yesterday

As pointed out by an analyst in a CryptoQuant post, the BTC miner reserve observed a plunge during the past day.

The “miner reserve” is an indicator that measures the total amount of Bitcoin currently stored in the wallets of all miners.

When the value of the metric rises up, it means a net number of coins are entering into miner wallets at the moment.

Such a trend, when prolonged, can suggest these chain validators are accumulating right now, and thus can be bullish for the crypto’s price.

On the other hand, a lowering value of the reserve indicates that miners are withdrawing a net amount of BTC currently.

Related Reading | Bitcoin Volume Saw False Spike Due To Binance’s Fee Removal

Since they usually transfer out their coins for selling on exchanges, this kind of trend can be bearish for the value of BTC.

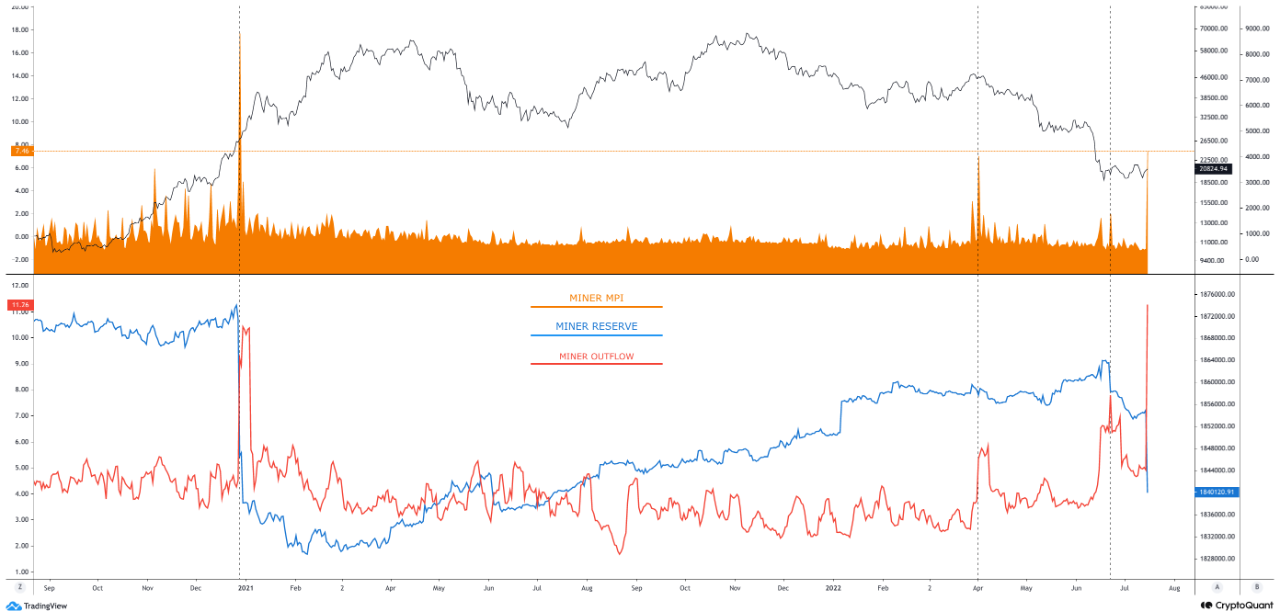

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past couple of years:

Looks like the value of the indicator has sharply declined recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin miner reserve has observed a significant decrease over the past day.

The chart also includes the data for two other indicators: the BTC miners’ position index and the BTC miner outflows.

Related Reading | Here’s Who Was Behind Bitcoin’s Recovery To $22,000 According To Open Interest

The outflow is just the total amount of coins exiting miner wallets. As expected from the plunge in the reserve, this metric has also sharply decreased in value.

What the “miners’ position index” (MPI) does is that it compares this current outflow value to the 365-day moving average of the same.

This tells us about how the current miner selling may compare with that observed during the period of the last year.

This indicator registered a big spike yesterday. The last two times such large spikes were seen, Bitcoin started going down a while later (or immediately in case of the spike in April).

If the past trend is anything to go by, this may likely turn out to be bearish for the value of the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats around $20.7k, down 4% in the last seven days. Over the past month, the crypto has lost 8% in value.

The price of the coin seems to have stagnated during the past couple of days after a move up | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com

by Hououin Kyouma via Bitcoinist.com

Comments

Post a Comment