Data shows the recent Bitcoin hashrate downtrend has lead to the largest negative adjustment in the mining difficulty during the past year.

Bitcoin Mining Difficulty Plunges Down As Hashrate Continues To Decline

According to the latest weekly report from Arcane Research, Thursday will observe the largest mining difficulty drawdown since the July of 2021.

The “mining hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin blockchain.

The higher the value of the metric is, the better is the network performance usually, and the more decentralized the hashrate is, the stronger is the network security.

The hashrate also represents the competition between the different miners connected to the chain. As such, when the indicator trends up, the “mining difficulty” also goes up.

This happens because the Bitcoin network has to maintain a constant block discovery rate. Since more mining power means miners now hash transactions faster, the block rate also goes up. And to compensate for it, the network increases the difficulty.

Related Reading | How The Ethereum Rally Is Propping Up Large Cap Cryptocurrencies

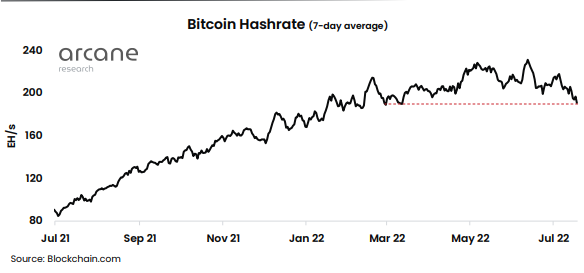

Naturally, a declining hashrate can lead to negative adjustments in the difficulty. The below chart shows how the BTC hashrate has changed during the past year.

Looks like the value of the metric has observed some decline during the last few weeks | Source: Arcane Research's The Weekly Update - Week 28, 2022

As you can see in the above graph, the 7-day average Bitcoin mining hashrate has gone down recently and is now around the same level as in March of this year.

The latest drawdown has been so sharp that the mining difficulty will see the largest negative adjustment since one year ago on this Thursday.

Related Reading | Uniglo (GLO) Brings Forth Fractionalized Asset Ownership, Overshadowing Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)

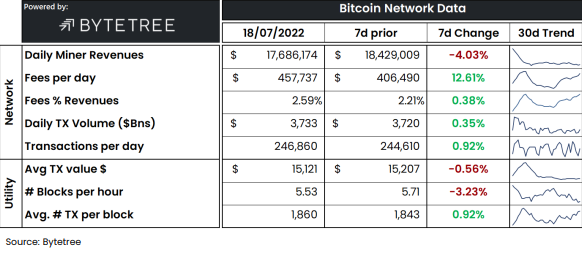

Here is a table that shows how the different miner-related metrics have changed during the last week:

The daily miner revenues seem to have plummeted 4% in the past seven days | Source: Arcane Research's The Weekly Update - Week 28, 2022

The block rate has fallen to jut 5.53 per hour, which is significantly lower than the 6 per hour value that the network requires. Because of this, the difficulty is expected to decrease almost 6% in the next adjustment.

BTC Price

At the time of writing, Bitcoin’s price floats around $23.6k, up 20% in the last seven days. Over the past month, the crypto has gained 15% in value.

The below chart shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have sharply risen up during the last couple of days | Source: BTCUSD on TradingView

Featured image from Brian Wangenheim on Unsplash.com, charts from TradingView.com, Arcane Research

by Hououin Kyouma via Bitcoinist.com

Comments

Post a Comment