Venezuela transacted more hyperinflated bolivars for bitcoins than ever before last week — but actual Bitcoin (BTC) volumes still decreased.

Hyperinflation Bites Bitcoin Traders

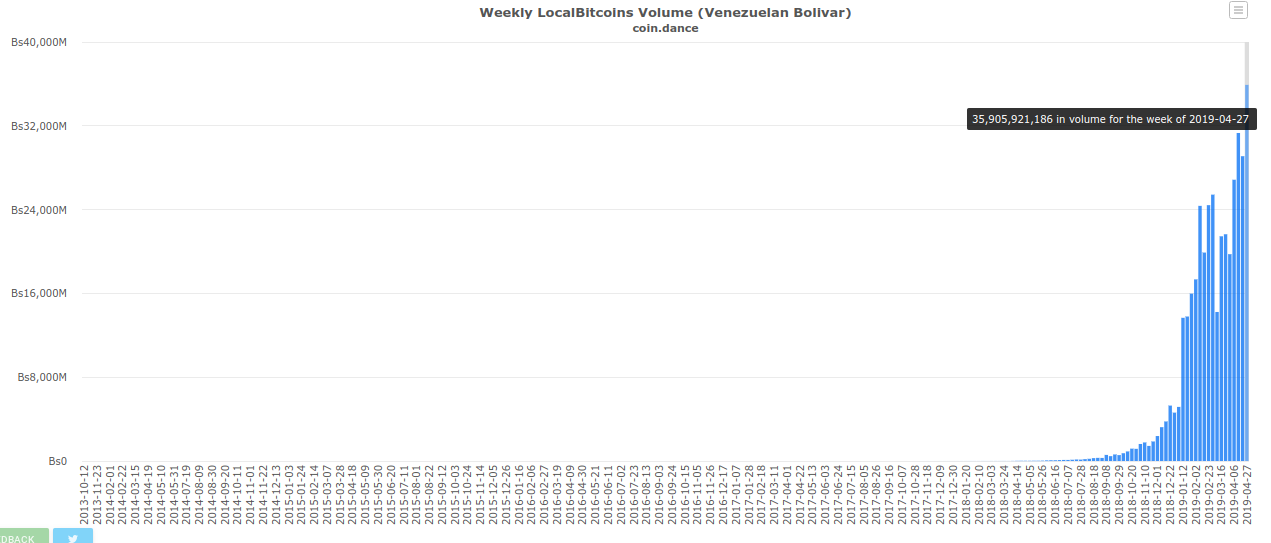

Data from monitoring resource Coin.Dance — which tracks trading volumes on P2P platforms Localbitcoins, Paxful, and Bisq — shows total volumes in Venezuela on Localbitcoins reached 35.9 billion sovereign bolivars (VES) for the week ending April 27. That number marks the highest in history according to the site’s records, the weekly performance squarely beating the previous high of 31.3 billion VES set two weeks prior.

This week’s record, however, differed from the past. As Bitcoinist reported, the hyperinflation affecting Venezuela’s fledgling national currency is forecast to hit 8 million percent in 2019. In line with that worrying trend, the bolivars transacted through Localbitcoins last week actually totaled significantly less in BTC terms than previous weeks.

The 35.9 billion VES was equivalent to 1208 BTC ($6.23 million), while the 31.3 billion VES from earlier in April 1454 BTC (currently $7.5 million), Coin.Dance suggests.

More And More Choose Bitcoin Safety

The dubious record came as Venezuela’s government and partially-recognized president Nicolas Maduro renewed calls for foreign investors to inject cash into the country’s embattled economy.

In a live address last week, Maduro specifically appealed to overseas parties to buy up his administration’s controversial cryptocurrency, Petro. Ostensibly tied to Venezuela’s oil reserves and debuting with a $5.9 billion market cap, critics immediately lambasted Petro when it appeared last year. Among its inadequacies, research showed Venezuela’s state oil company had debts multiple times the size of Petro’s market cap. In the interim period, various governments have sanctioned Petro altogether, barring their citizens from investing.

Meanwhile, the trend set by Venezuela continues to play out across neighboring South American economies. As Bitcoinist previously noted, Colombia, Peru and chiefly Argentina have also set higher Bitcoin trading volumes in recent months. In March, Tim Draper, a major Bitcoin bull and famous for his sky-high Bitcoin price forecasts, even met with Argentina’s president to discuss the economy and reportedly made a Bitcoin bet with him.

“[I]f the peso is valued more than Bitcoin, I double the investment I am making in the country; and if Bitcoin acquires more value than the peso… that would be a perfect solution because there is no confidence in the currency,” the mogul said about the plan quoted by a local news agency.

Meanwhile, In Mexico…

Elsewhere on the continent, citizens are turning to Bitcoin in greater numbers for other reasons. The US’ threat to cut off remittances to Mexico, for example, coincided with an uptick in Bitcoin activity, as workers eye the possibility of using a borderless currency to continue their activities unhindered. Mexico’s overall volumes remain comparatively low, with 56 BTC ($288,000) changing hands on Localbitcoins last week.

What do you think about Venezuela’s Bitcoin trading volume? Let us know in the comments below!

Images courtesy of Coin.Dance.

The post Venezuela Bitcoin Trading Record Underscores Fiat Currency Hyperinflation appeared first on Bitcoinist.com.

by Esther Kim via Bitcoinist.com

Comments

Post a Comment